Last week I discussed the types of scams used to take your money! This week I want to share with you some methods that can help you beat the scammers at their game.

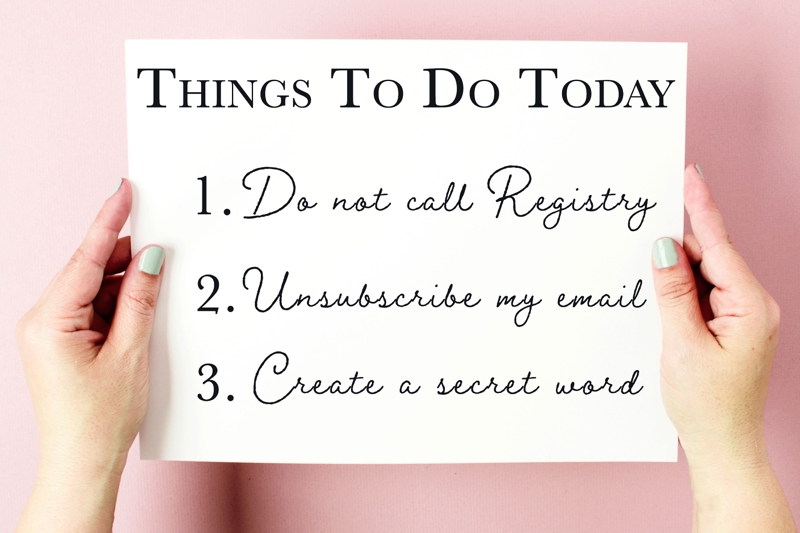

The first step in protecting yourself from scammers is to crawl under a rock… I’m just joking! But seriously, scammers are everywhere and target everyone. But the easier it is to find your information, the easier it is for them to contact you. Here are some things you can do today:

- Unlist your phone number

- National Do Not Call Registry online or 1-888-382-1222.

- Tennessee residents: Fill out the Tennessee Online Do Not Call Registration form.

- Opt out of “people” search engines. Here are the basic steps for opting out of people search engines:

– First: Do an internet search on yourself. Where is your information listed?

– Next: Find your listing on each website. Once you have the listing, write down the URL or ID number.

– Finally: Use the IRL or ID for your listing and enter them into the opt out pages for each search engine.

Here are a few of the people search engine links to get you started:- White pages opt out page.

- Spokeo opt out page.

- PeekYou opt out page.

- BeenVerified opt out page

While it may take a little time and effort, it is beneficial to your sanity to request your information be taken off of these websites!

- Unsubscribe from email listings whenever possible. If you find you are suddenly getting emails for a business or organization you didn’t sign up for, simply label it “Junk” and move on. Your email provider will take care of the rest.

- Do a privacy check up on your social media accounts. Set high limits on security and privacy on your social media accounts. Don’t let strangers message you. Unfriend anyone you don’t personally know.

The next step in fortifying your finances is to be overly cautious when talking to people you don’t know.

- Don’t answer phone calls from numbers that are not programmed into your contacts. If it’s important, they will leave you a voicemail. If you accidentally answer the phone and you have no idea who is calling, don’t say anything other than normal pleasantries such as “hello” or “oh, that’s interesting”. Have a “refusal” script handy near the phone. It’s perfectly okay to say “I have to go now…” and simply hang up.

- Create a “secret word” – The easiest way to protect yourself from a telemarketing or grandparent scam is to create a secret word. A secret word is a “code word” or phrase that only your loved ones will know. If the caller doesn’t know the secret word, then they don’t know you.

- Follow the proper channels for communicating with government services. The IRS, Medicare, and Social Security will never call you! Nor will any correspondence be an emergency! There’s too much bureaucracy for urgency. For example, if the IRS wants to get in touch, they will send an official letter. That guy on the phone telling you that you owe past taxes and will go to jail is not from the IRS- he’s a scammer! And finally, never give your Medicare or Social Security information over the phone unless you initiated the phone call directly to the agency.

And finally here are some other very smart ways to stop scams:

- Never click on a link within an email. I know this is a hard and fast rule, but the extra time it takes to navigate to a website outside of your email is worth your financial safety.

- Don’t rush into making major financial decisions. Shop around and do your research before altering your home mortgage, making major home repairs, or changing your investments. Review all contracts until you are comfortable that you understand what you are required to do, what the other party must do, and what happens if something goes wrong. And finally, don’t hesitate to have someone else review your important documents.

- Subscribe to a fraud monitoring plan. If you don’t want to fuss around with monitoring your credit or data on the web use a credit monitoring subscription instead. Companies such as LifeLock and EverSafe offer paid subscriptions that monitor your information and alert you to suspicious activity.

- Set up safeguards at the bank. If someone else assists you with making purchases, consider giving them a credit or debit card with pre-set limits. Additionally, make sure your caregiver is being paid a fair wage and has fair amounts of time off- this will reduce the financial pressure on them to steal.

- Create a trust. Creating a trust is a great way to have control over what happens to your assets, especially if you become incapacitated. Trusts aren’t easy to change and provide rules and limitations over who has access to your assets.

- If possible, hire a team. Life is much less complicated when you have a professional accountant, financial advisor, and attorney on your side. Leave the legal and financial details to the people who keep up to date on the current federal rules and regulations.

- And most importantly: Do not become isolated. No one gets through life alone. We all need a village to help more or less at certain stages of life. Just like you would have a neighbor keep an eye on your house during vacation, having a support system keeping an eye out for you is always a good thing. And you can do the same for them!

I hope this list has motivated you to reassess your financial security measures. There are so many actions that you can do today! Which one are you going to do first?

If you’re looking for an attorney who focuses on Elder Law, please don’t hesitate to reach out. It costs nothing to schedule a 15 minute consultation with the team at GALS!